Economic Crime Levy

Economic Crime Levy

- Is your entity supervised under the Money Laundering Regulations (MLR)?

- Does your UK income exceed £10.2m per year?

If you have answered yes to both of the above, unfortunately, you are facing a new annual tax in the form of the Economic Crime Levy (ECL), with the first return and payment due 30 September 2023.

So, if your entity, which includes individuals, companies, LLPs or responsible partners in a partnership, is supervised for MLR then you must register online with one of the collection authorities, being: HMRC; the Financial Conduct Authority (FCA); or Gaming Commission (GC).

The three collection authorities each have their own procedures and guides, which are summarised and linked below. So, the first step is to know which one to register with – if you are supervised by the FCA or GC then you have to register with them and make your payment to them, if you are not supervised by the FCA or GC then you must follow the HMRC route.

HMRC

If you are required to register with HMRC, go to – https://www.gov.uk/guidance/register-for-the-economic-crime-levy and once done you will be issued with a reference number starting with a ‘X’ please do note this down as it is important. Please note that Ensors as your tax agent would not be able to register for you.

You will be required to complete and submit an annual return online, covering:

- Length of your relevant accounting period

- UK revenue for that period

- Whether you commenced or ceased MLR regulated activity in that period

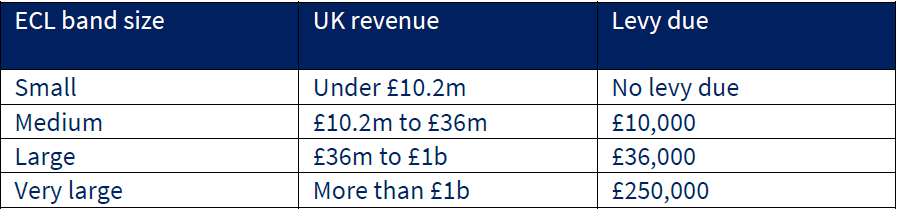

- Your ECL band and amount due – see below table

Returns are required to be submitted by 30 September each year. The payment to HMRC is also due 30 September, commencing 30 September 2023 based on your previous financial year end.

The bandings for payment are:

If your accounting period is less than twelve months, the bands are adjusted accordingly.

Further information on the HMRC registration and returns can be found at Get ready for the Economic Crime Levy – GOV.UK (www.gov.uk).

FCA

The FCA is responsible for collecting the levy from the entities supervised under MLR by them.

Impacted firms, who were subject to the MRL between 6 April 2022 and 5 April 2023 will see this new tax levy appear on their invoices from July 2023. With this being paid annually based on the UK revenue, as per the above bandings.

To ensure the FCA are correctly billing the levy, all firms must submit their data via new ‘Reg Data Report FINE074’. Failure to correctly submit this data in time may result in a £250 administrative fee.

More details for FCA supervised entities can be found at FCA to collect Treasury’s economic crime levy (Anti-Money Laundering) from July | FCA.

GC

For any casino operators, the new levy will be collected by the GC, relating to any operators supervised during the financial year 1 April 2022 to 31 March 2023, based on the bandings, as shown above.

If your UK revenue is below the £10.2m banding, you will still need to submit a return to the GC, even though no payment would be due. The returns will cover the same points as the return required by HMRC.

The Commission has stated they will provide operators with details of the way to submit their returns. But any effected operators must notify the Commission that they are liable to the levy and calculate their appropriate banding.

More details for GC supervised entities can be found at Introduction (gamblingcommission.gov.uk)

Summary

The approach may slightly differ between the three collection agents, however, there is a need for any MRL supervised entities to report and for any with income over £10.2m to pay by 30 September 2023, so if you are impacted, please take the appropriate steps.

Whilst we cannot register you with HMRC, if you do have any queries on calculating periods or bandings, please ask your usual Ensors contact for support.