Double cab pickup trucks – is your business going to be affected?

Update: Further to this insight being published on 16 February, it was announced on 19 February that the government had retracted this legislation. The original insight can be found below, however please note that Ensors no longer endorses its accuracy. For the latest information on this change, click here: Update on HMRC Double Cab Pick Up Guidance – GOV.UK (www.gov.uk)

HMRC have quietly made a change to their Capital Allowances Manual and Employment Income Manual on their interpretation of the legislation around the definition of a van.

As many businesses will know, double cab pickups have historically been treated as a van and not as a car, for benefit in kind (BIK) and Capital Allowances (CA) purposes, as a result of having a payload of over one tonne. This has meant that businesses could potentially claim either 100% Annual Investment Allowance (AIA) or Writing Down Allowance (WDA) at a rate of 18% on the purchase of a pickup (for partnerships this would be subject to the usual private use restrictions). Where any employees have been provided with a pickup for private use, this has been under the van rate for BIK purposes.

However, from July 2024 HMRC have stated that they will no longer automatically interpret a van as being anything with a payload of over one tonne. Instead, a vehicle will now only be classed as a van if the vehicle is “of a construction primarily suited for the conveyance of goods or burden of any description”. Their guidance furthermore suggests that if a vehicle is marketed as a multi-purpose vehicle, or where it is uncertain what the dominant purpose of the vehicle is, it will be treated as a car. HMRC expect most double cab pickups to be caught by this, as they state that double cabs are both equally suited to conveying passengers and goods.

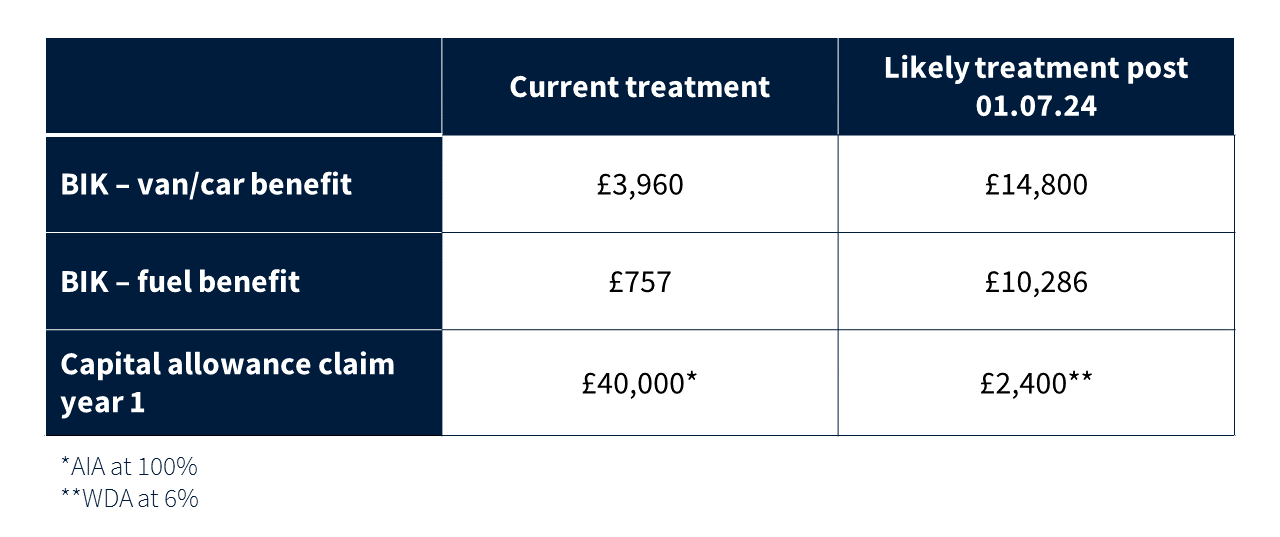

The table below show the potential impact of these changes in a company structure on the purchase of a “typical” double-cab pickup with a purchase price and list price of £40,000, CO2 emissions of 200g/km and with private usage:

Please note the capital allowance figures above are based on company structures – if you operate through an unincorporated partnership the position may be different.

If you currently have a double-cab pickup, the current treatment will run until the earlier of disposal of vehicle, lease expiry or 5 April 2028. As the rules do not come in until 1 July 2024, there is also some scope to purchase a double-cab pickup and continue to receive the preferential treatment for a while longer, with this preferential treatment covering double-cabs ordered under contract before 1 July 2024, with the expenditure being prior to 1 January 2025.

If you want to know how this will affect your business, please speak to one of our team.