Land, property and construction – keeping our forensic accounting team busy since 2014

Share:

Since Ensors began specialising in forensic accountancy 5 years ago, we have worked on a huge range of cases spread across many different industries.

One particular industry sector features heavily in our case load. Cases which could be described as in the land, property or construction sector make up 26% of all assignments we have undertaken in the last 5 years.

For reference, the next highest sector accounts for 17% of the cases, followed by a sharp drop down to 6% for the third most popular industry.

To add balance, the presence of tangible assets probably means that more potential disputes in these sectors gain momentum due to the promise of gold at the end of the rainbow.

However, those who have worked with individuals in these sectors will know that the character needed to survive and flourish in this tough industry means that arguments and disputes are rarely shied away from.

Construction sector review – reactive in nature

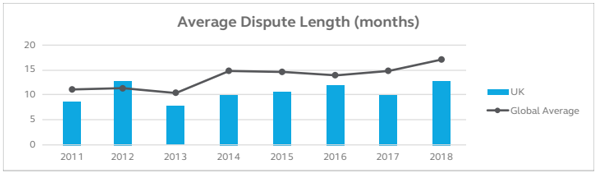

The Arcadis Global Construction Disputes Review 2019 noted that the average dispute length in UK is increasing and that potential pinch points are rarely addressed before crystallisation.

This review is primarily looking at contracts of a larger scale but it is clear that this culture filters down throughout the sector.

It is not unusual for potential areas of dispute to be identified only when the area becomes contentious, although this seems to be slowly changing in other sectors with our forensic accounting team being called on more often to provide proactive advice rather than reactive. In construction this is not yet evident to us.

Our experience in this sector

We have provided assistance in a number of disputes relating to JVs and unfortunately most follow a similar theme, where one party has a disproportionate amount of power due to their deeper pockets. At the outset of starting a potential litigation process it is important to weigh up the cost of seeing a dispute through to its resolution against the potential outcome which could be achieved. Disputes, particularly in a deadlock scenario, come at a high emotional burden as well as financial cost. That said, although escalation can be expensive, it is sometimes required.

Particularly in the case of JVs, some steps can be taken at the outset of a project to provide protection against later pressure which could occur.

A well drafted Shareholders/JV agreement is a must. This agreement will lay out the key terms and provide protection to both parties. Sometimes one party will shy away from raising this issue due to concerns it will cause friction with the other party. If this is the dynamic before a project begins in earnest, then it is clear that the tension will be built rapidly if a contentious matter arises. Although there will probably still be grey areas in any project, a well drafted agreement minimises the number of these.

If one party is not in control of a project on a day to day basis, for example where the other party is fulfilling a developer’s role, it is important to keep as much information as possible throughout the project. Not everything can be reassembled at a later date and if reconstruction of records is possible, it will probably be much more difficult and expensive to do so.

Projects are fast moving so there is a need to be organised from the outset. We have worked on disputes where the historical reports of QS’ have been questioned and there has been a feeling that materials were being used on a different site owned by the developers outside of the JV. If a party feels this is a particularly high risk, they may want to suggest independent verification at stages throughout the process. Again, it is much easier to suggest these measures at the outset of a project rather than once a relationship has begun to fray.

In this hypothetical JV situation, we would suggest that a monthly cost breakdown and comparison against budget is requested – not just a forecast headline profit. Without obtaining the breakdown it becomes much easier for somebody to manipulate and smooth costs at a later date if your partner transpires to be unscrupulous.

A key feature of dishonest activity across any sector is to over complicate explanations of information so that the understanding of what drives the figures is lost.

Please contact Simon Martin if you require assistance with any of the topics raised in this article.