The changes to dividend taxes in the summer Budget came as a surprise to most of us. Strangely, pre-election, I had been braced for it, as this was a Liberal Democrat policy which I had a feeling a Labour / SNP coalition would adopt. With the Conservatives in office I had dismissed such changes, reassured by their election pledge not to put up income tax; but it turns out the pledge was carefully worded so as not to cover the dividends position… What they have actually done is add more teeth to the Lib Dem policy.

For those who have not caught up with it, the basic position is that income tax on dividends will change from 6 April 2016. The somewhat bizarre 10% “notional tax credit”, will be scrapped. Everybody will be given a £5,000 dividend exemption, meaning that many small investors who pay higher rate tax will actually be better off than they were before. However, for dividends received over that level, new rates of tax apply, and these are compared in the table to those effective rates which applied before (ignoring the notional tax credit):-

| Old Effective Rate | New Rate | |

| Basic rate taxpayer | 0% | 7.5% |

| Higher rate taxpayer | 25% | 32.5% |

| Additional rate taxpayer | 30.6% | 38.1% |

Owner Managed Companies

This is of most concern to those owner managed companies who extract significant amounts of profit by way of dividends; something which has for a long time been an efficient form of tax planning when combined with a low salary. The changes mean that any individual who takes more than about £16,000 out of their company will be worse off.

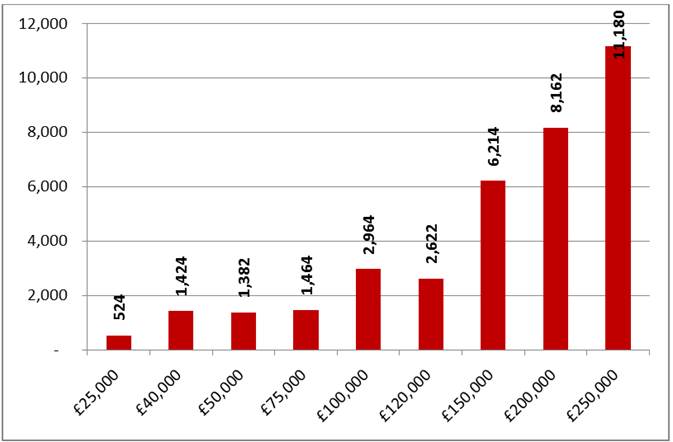

How much worse off will depend on a number of factors; profit levels, business add-backs, whether profits are retained in the company, cars and other benefits etc. However, by way of example, with a company owned by a single shareholder, with no add-backs, cars, benefits etc, where all profits are extracted, then the additional cost could be approximately as follows:-

In most cases, it is not going to change your decision of whether to pay dividends rather than salary, as there is still a tax benefit here. However, it will focus the mind on looking at all areas of the profit extraction strategy to see if things can be optimised, including salary, dividends, shared ownership within the family, company cars and other benefits etc.

Whether to Incorporate?

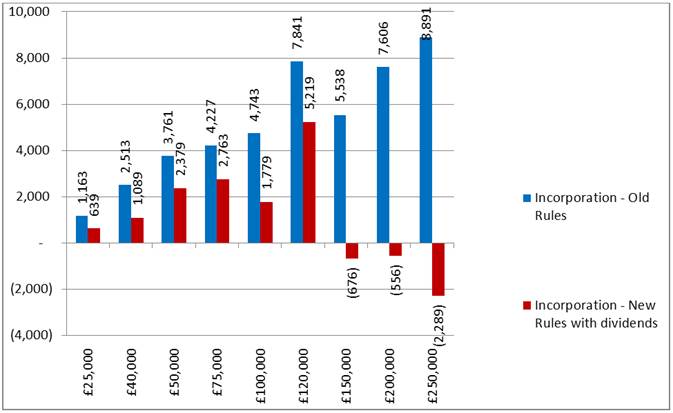

The changes will also impact upon the decision of a sole trader or partnership to incorporate. In times past, incorporation could potentially deliver a tax benefit, depending on the exact circumstances. In most cases, it still will, but the benefit will have been reduced (and in some cases with profits above about £140,000 per person, reversed).

The following table estimates the likely tax savings for a sole trader who incorporates, both under the old rules (in blue) and the new rules (in red), based on the following assumptions:-

- 2015/16 tax rates and thresholds

- No add-backs

- All profits drawn using a salary of £10,000 then dividends

- Ignores cars

By the time the costs of conversion and running a company have been factored in, the decision is now likely to be far less clear cut in most cases, but there is still no “one size fits all” approach.

Tip of the Ice-berg?

At the start I mentioned that Tory income tax pledge. It promises not put up the basic rate of income tax beyond 20%, the higher rate beyond 40% and the additional rate beyond 45%. But of course, the dividend rates are still much lower than this. Will there be more to come…?